Trends like delinquency rates, loan originations, and the health of bank portfolios provides a comprehensive view of CRE dynamics. As commercial real estate (CRE) adapts to evolving economic conditions, understanding the state of large loans across asset types is critical. This article builds on insights from Trepp’s analysis of market conditions, offering a detailed look at the opportunities and challenges in today’s environment.

Bank CRE Loan Delinquency Rates: By Property-Type

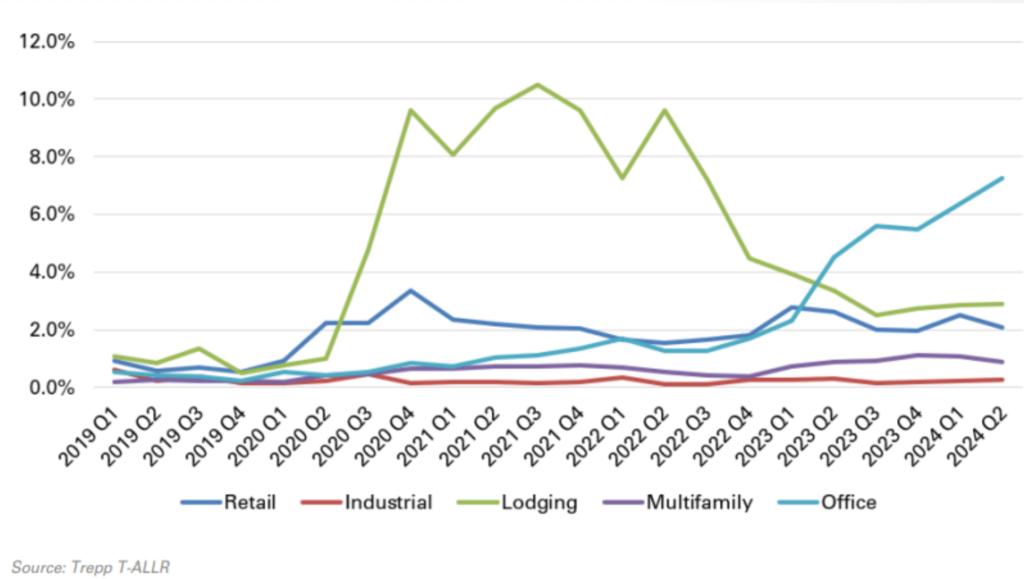

Loan delinquency rates remain a key indicator of market health. The latest data underscores disparities across property types, reflecting structural shifts and demand trends:

-

Office Properties: With urban office delinquency rates surpassing suburban rates for the first time, this sector highlights challenges such as remote work adoption and rising vacancies. The tightening of underwriting standards in 2023 has made refinancing and origination more difficult, compounding pressures.

-

Multifamily Properties: Multifamily assets continue to exhibit resilience, supported by the sustained demand for rental housing. With the lowest criticized loan levels among property types, multifamily remains a preferred asset class for lenders and investors alike.

-

Industrial Properties: Bolstered by e-commerce growth, industrial real estate maintains one of the lowest delinquency rates. Its fundamentals remain strong, particularly in logistics and warehousing, making it a cornerstone of stability in lender portfolios.

Bank Loan Delinquency Rates by Property Type

(source: Trepp, Inc)

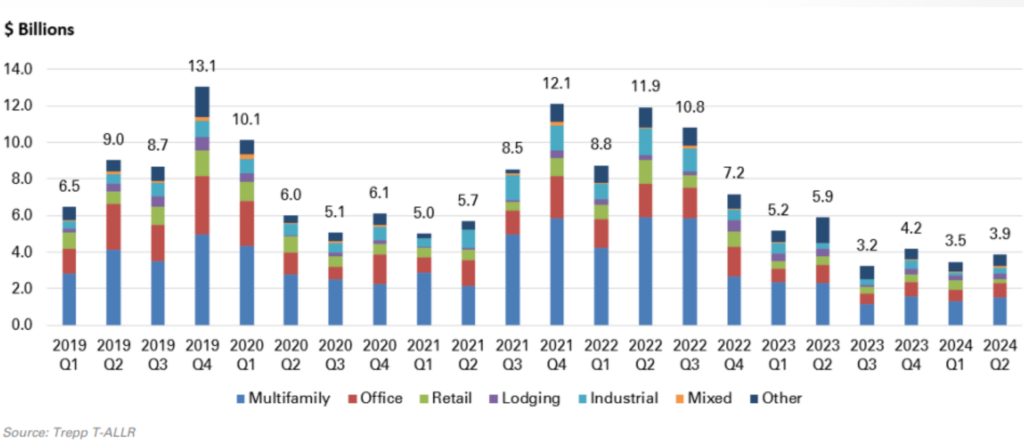

Trends in CRE Loan Originations

Analyzing loan origination data offers insight into market sentiment and sector performance:

-

Decline in Office Loan Originations: As office properties face structural and cyclical challenges, banks have reduced their exposure to this segment. The shift toward more conservative underwriting reflects the sector’s elevated risk profile.

-

Steady Multifamily Activity: Multifamily properties continue to attract lender confidence, driven by urban and suburban housing demand. Limited housing supply in these areas reinforces the need for new developments, sustaining origination activity.

-

Growth in Industrial Loans: With strong investor interest and tenant demand, industrial loan originations remain robust. This trend reflects confidence in the sector’s continued expansion.

Bank CRE Loan Originations

(source: Trepp, Inc)

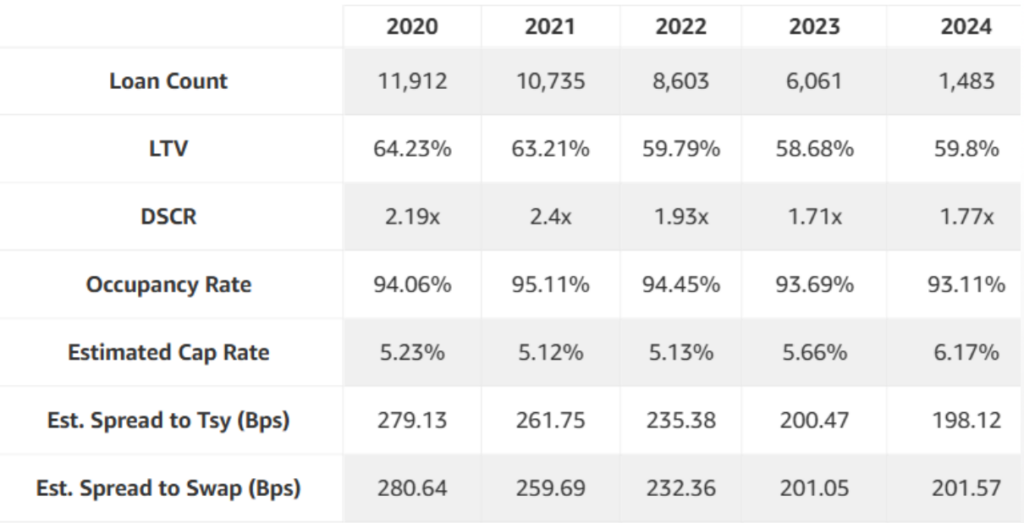

The Maturity Schedule: Refinancing Risks Loom

Loan maturity schedules present an additional challenge, particularly for office and retail assets. A significant volume of loans is set to mature over the next two years, raising concerns about borrowers’ ability to refinance under tighter conditions. For assets with declining valuations, this could trigger more distress in already-struggling sectors like office real estate.

Bank Balance Sheet Health and Exposure by Property Type

Banks’ exposure to different property types significantly impacts their balance sheet health:

-

High Office Exposure: Institutions with a high concentration of office loans face heightened vulnerability to market fluctuations. The data suggests that banks with diversified CRE portfolios—emphasizing multifamily and industrial properties—are better positioned to mitigate risks.

-

Diversification as a Shield: Multifamily and industrial allocations continue to stabilize bank portfolios, reflecting their strong fundamentals and lower delinquency rates.

Sector-Specific Insights: Opportunities and Challenges

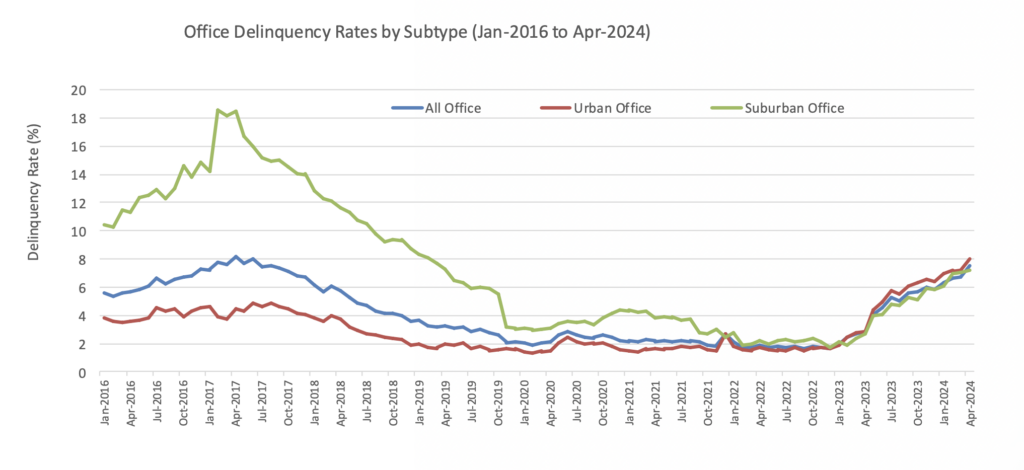

(1) Office Real Estate:

(a) Urban office markets face heightened risks due to lower occupancy rates and declining property valuations.

(b) Suburban offices, while outperforming urban properties, remain susceptible to local economic conditions.

(source: Trepp, Inc)

(c) Financial and Operational Stress; The broader office sector struggles with:

Rising Costs: Property taxes, insurance premiums, and maintenance costs have climbed sharply.

Loan Maturities: Many loans maturing in 2024–2025 face refinancing risks due to stricter lending criteria and higher interest rates.

(d) Strategies such as adaptive reuse, converting office spaces into mixed-use developments, and emphasizing tenant retention through upgraded amenities can mitigate some of these challenges.

(2) Multifamily Real Estate:

-

-

This sector benefits from consistent rental demand and low vacancy rates. It continues to provide a hedge against economic volatility.

-

The multifamily sector continues to demonstrate resilience, supported by strong housing demand and favorable demographics. CMBS-backed multifamily loans maintain some of the lowest delinquency rates across property types, reflecting the sector’s robust fundamentals.

-

(source: Trepp, Inc)

(3) Industrial Real Estate:

-

-

Industrial properties shine as the top-performing asset class, with demand driven by supply chain evolution and technological integration.

-

Industrial properties now extend beyond warehouses to include data centers. With the increasing reliance on cloud computing and digital infrastructure, these properties represent a growing niche within industrial real estate.

-

(source: Trepp, Inc)

Criticized Loans: Spotlight on Distressed Assets

The volume of criticized loans (those categorized as substandard, doubtful, or loss) underscores sector vulnerabilities:

-

Office Properties: With rising vacancies and softening rents, office properties represent a significant portion of criticized loans.

-

Multifamily and Industrial Properties: These sectors exhibit comparatively fewer issues, highlighting their resilience amid broader challenges.

Market Takeaways

The findings suggest key strategies for market participants:

-

Tailored Investment Approaches: Investors and lenders must align strategies with sector-specific dynamics. Industrial properties offer growth potential, while office assets demand a cautious approach.

-

Refinancing Preparedness: With significant loan maturities approaching, proactive borrower-lender engagement is essential to mitigate refinancing challenges.

-

Focus on Resilient Sectors: Multifamily and industrial properties continue to attract interest due to their stability and low delinquency rates.

Conclusion

Understanding delinquency trends, origination activity, and sector-specific challenges is essential for navigating today’s CRE landscape. Investors, lenders, and stakeholders can leverage these insights to make informed decisions, aligning with market realities and mitigating risks.

This analysis builds on data and expertise from Trepp, a leading provider of CRE analytics. For more in-depth coverage, visit www.trepp.com for insights into the state of CRE commercial loans.

Thank you for exploring the state of large loans outstanding in commercial real estate. If you’re navigating complex CRE trends or need personalized insights into your investments, feel free to reach out to the ICRE Investment Team. We’re always glad to help you make informed decisions in a rapidly evolving market!