Green buildings often result in lower operating costs these savings can be substantial, leading to higher net operating incomes. In the evolving landscape of commercial real estate, a significant and impactful trend has emerged: the move towards green investments. As awareness of environmental issues grows, so does the interest in green investments in commercial real estate. This movement isn’t just about being eco-friendly; it’s proving to be a lucrative approach for forward-thinking investors.

The Rising Demand for Sustainability

There’s a growing demand for sustainable buildings among tenants and buyers. Companies are seeking eco-friendly spaces to align with their corporate social responsibility goals and to appeal to a more environmentally conscious consumer base. The demand for sustainable buildings is driven by a combination of consumer preference, regulatory pressures, and the undeniable benefits of energy efficiency.

Financial Incentives and Returns

Investing in green commercial real estate isn’t just good for the planet; it’s good for the pocket too. Green buildings often result in lower operating costs due to more efficient use of resources like water, energy, sustainable materials, and lower carbon footprints. Over time, these savings can be substantial, leading to higher net operating incomes and, consequently, increased property values. Additionally, many governments offer tax incentives, rebates, and grants for green building initiatives, further enhancing the financial appeal of these investments.

The growing interest in sustainable properties, coupled with their limited availability, means green buildings often achieve greater resale values compared to traditional structures. This upward trend in value is also fueled by the increasing focus on ESG compliance among businesses, as well as the heightened preference of tenants for residing and working in environmentally sustainable buildings. Various studies indicate that the asset value of such green buildings can experience an uplift ranging from 7.0% to 18%.

Risk Mitigation

Sustainable properties are typically better equipped to meet future regulatory changes and are less likely to become obsolete, they present a lower profile. As the world gravitates towards more strict environmental regulations, traditional properties may face obsolescence or costly upgrades. Green buildings, already aligned with future standards, are a step ahead, safeguarding your investment against regulatory shifts.

Improved Market Appeal and Higher Occupancy Levels

Green buildings typically experience higher rates of occupancy and have the potential to attract higher rental rates. Their market appeal is increased by their attractiveness to a wider variety of tenants who are looking for workspaces that are healthier and more environmentally sustainable. This is especially evident in urban regions, where there is intense competition for tenants and where being sustainable can serve as a significant distinguishing factor.

According to Evora global, around 80% of large investors believe the biggest opportunity arising from climate resilience will be increased investment and tenant demand for green buildings.

ESG Investing – a Growing Trend

Investors are now placing a greater emphasis on Environmental, Social, and Governance (ESG) factors when assessing properties. They are keenly focused on the environmental footprint and sustainability efforts associated with their investments. This move towards ethical investing is more than just a fleeting trend; it is evolving into a key consideration for a significant number of institutional investors.

Additionally, “firms that prioritize sustainability are likely to be viewed more favorably by investors and stakeholders, which can translate into increased demand for their properties and higher valuations.” Read more about how ESG will impact Commercial Real Estate in this article.

The Role of Technology in Green Commercial Real Estate

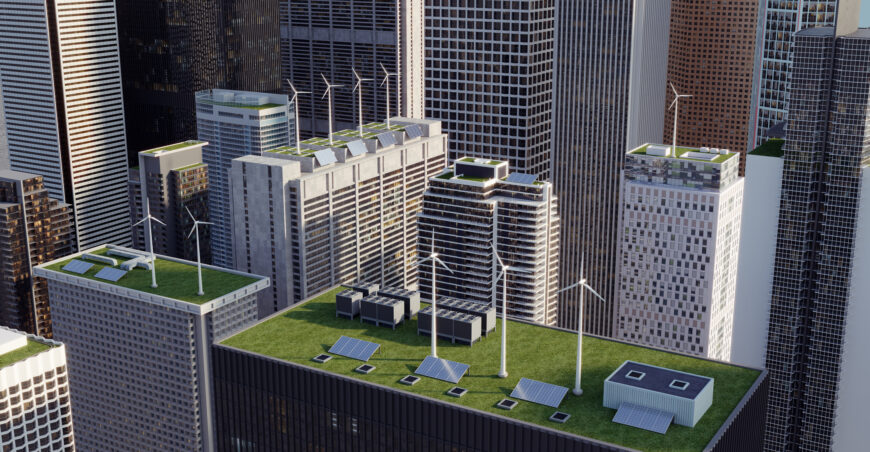

The integration of technology in green commercial real estate is essential. Leading this transformation are smart building technologies, energy management systems, and eco-friendly construction methods. The rise of smart buildings is a notable trend in the commercial real estate sector, thanks to advancements in technology. These innovative structures leverage data and automation to enhance efficiency and minimize waste. At the same time, they boost comfort and productivity for those who use the space.

This transition towards green real estate is not just beneficial for the environment but also economically advantageous for property investors and owners.

Challenges and Opportunities

While the benefits are clear, green investments do come with challenges. The initial cost of upgrading or developing sustainable properties can be high. Moreover, staying up to date with the evolving sustainability standards and regulations requires expertise and ongoing commitment. Although the initial cost of incorporating sustainable features can be higher than traditional methods, the long-term savings and potential returns justify these upfront investments.

Moving towards environmentally friendly investments in commercial real estate creates a beneficial situation for both the planet and investors. This approach combines economic benefits with ecological stewardship, paving a sustainable way for the industry’s future. As this movement grows in popularity, it’s poised to significantly influence the commercial real estate landscape, turning green investments from an option into an essential consideration for progressive investors.

If you are interested in learning more about the commercial real estate market in Phoenix or other markets, feel free to reach out to us at ICRE Investment Team anytime. We’d be happy to help supply you with information on any relevant properties or markets, alongside any connections in lending, investing, or consulting that you might need!